oregon tax payment due date

If you choose this installment schedule the final one-third payment is due on or before May 15. The first payment is due by November 15th.

2022 third quarter individual estimated tax payments.

. In Oregon real property is normally subject to foreclosure three years after the taxes become delinquent. 3rd 7-1 to 9-30 October 20. 2022 second quarter individual estimated tax payments.

Full payment with a 3 discount. Filing due dates for quarterly returns. Pay the one third payment amount on or before November 15.

When paying by mail please return the lower portion of your tax statements with your payment. To review for the 2020 tax year if you expect a Corporate Activity Tax liability of 10000 or more then you are required to make estimated quarterly payments. Those choosing to pay in installments will receive.

Most state extensions are due by April 18 2022. 2nd 4-1 to 6-30 July 20. 2021 individual income tax returns filed on extension.

Mail a check or money order. 4th 10-1 to 12-31 January 20. Submit your application by going to Revenue Online and clicking on Apply for ACH credit under Tools.

Returns due after May 15 2020 are not extended. Any tax payment with a. The second one-third payment is due by February 15 and the final one-third payment is due by May 15.

If paying in installments the final installment is due May 15 July 1 is the beginning of the new fiscal year. To receive an Oregon-only extension make your tax payment by the original return due date through Revenue Online or through the mail using a payment voucher Form OR-65-V. 13 payment with no discount.

By July 31 2020 those with substantial nexus with Oregon and an annual CAT liability exceeding 10000 must pay 25 of their CAT liability for the 2020 calendar year. 23 payment with a 2 discount. The return is due the 15 th day of the fourth month following the end of the tax year.

May 16 of the following year they are one year delinquent. If the taxes are not paid by then they are considered delinquent as of May 16. All payments must be made by the due date.

Property taxes can be paid in full by November 15 or in three installments. If Additional Tax Liability is due as a result of your amendment print a payment coupon and mail in the bottom portion with your check to the address on the payment coupon. November 15 February 15 and May 15.

An extension to file doesnt mean more time to pay. Annual Use Fuel User - Annual tax less than 10000 as authorized by the department. The payment plan due date is the 10th or the 25th of the month at least 16 days after the date the payment plan was set up.

The personal income tax returns filing and payment due date is extended from April 15 2020 to July 15 2020 including. The Oregon tax return filing due date for tax year 2019 is automatically extended from May 15 2020 until July 15 2020. Property Tax Payments Due.

13 payment with no discount. Tax Returns Due April 18th. 3 While Oregon has extended some of its tax filing and payment deadlines in response to the COVID-19 outbreak it has not extended the due dates for estimated quarterly payments.

Interest continues to accrue during the repayment period. Payment is coordinated through your financial institution and they may charge a fee for this service. State income tax extensions are listed by each state below.

23 payment with no discount. The maximum extended due date is September 15 2022 for calendar year partnerships. There is no discount.

Electronic payment from your checking or savings account through the Oregon Tax Payment System. Marion County encourages property owners to pay their taxes by mail. Interested in paying your taxes online click here.

The Department of Revenue is joining the IRS and automatically postponing the income tax filing due date for individuals for the 2020 tax year from April 15 2021 to May 17 2021. Benton County Tax Office. Certain items are excluded from the definition of commercial activity and therefore will not be subject to the CAT.

Individual taxpayers can also postpone state income tax payments for the 2020 tax year due on April 15 to May 17 without penalties and interest regardless of the amount owed. Pay the one third amount by November 15 no discount is allowed. Mail Tax Payments to.

In addition Oregons CAT allows a 35 percent subtraction for certain business expenses. Under the authority of ORS 305157 the director of the Department of Revenue has determined that the action of the IRS will impair the ability of Oregon taxpayers to take certain actions within the. 13 payment with no discount.

If you do not pay the additional liability at the time of your amendment you will be subject to interest for late payment for the period starting with the original due date April 1 until the amount due is paid. If you do not owe taxes many states grant an automatic 6 month extension period. Tax statements are sent to owners by October 25th each year.

Form OR-40 OR-40-N and OR-40-P Oregon Personal Income Tax return Form OR-41 Oregon Fiduciary return. Taxes are due November 15 and may be paid in thirds. If you do owe taxes paying state taxes online or via check serves as a state.

Reports must be received by the department on or before January 20 for each year. Oregon property taxes are assessed for the July 1st to June 30th fiscal year. If you choose this installment schedule the second one-third payment is due on or before February 15th and the third payment is due on or before May 15.

March 31 2021 likely does not apply April 30 2021 likely does not apply 2nd Apr-May-Jun. The deadline to file state and federal personal income tax returnsApril 18th and the Oregon Department of Revenue estimates that it. The February 1st deadline to make the 4th quarter payment for the Oregon Corporate Activity Tax CAT is coming up on us quickly.

Estimated payments which can be calculated using the estimated payments worksheet included in the CAT return instructions are due for the previous quarter on or before the last day of the 4 th 7 th and 10 th months of the tax year and on the last day of the first month immediately following the end of the tax year.

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Get Our Printable Eviction Notice Template Illinois Eviction Notice Being A Landlord Templates

Portland 90 Day Notice Of Rent Increase Ez Landlord Forms Being A Landlord Rental Property Management Rental Agreement Templates

Payment Agreement Templates Contracts ᐅ Template Lab With Regard To Legal Binding Contract Template 10 Payment Agreement Contract Template Document Templates

It S Tax Season Will My Alimony Be Tax Deductible In 2021

Oregon Property Tax Important Dates Annual Calendar Ticor Northwest

Tax Season 2022 When Can You File Taxes With Irs In 2022 Money

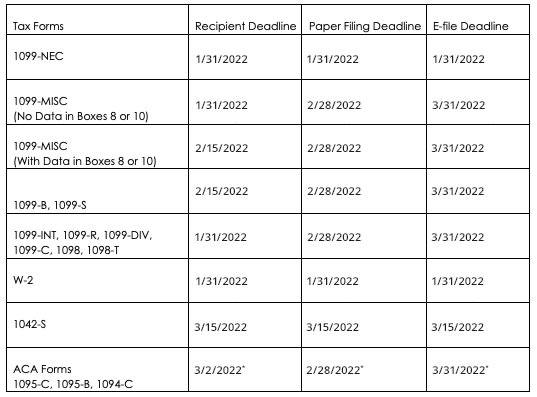

2021 Tax Returns Deadlines And New Developments For Employers

Basic Schedule D Instructions H R Block

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Understanding Your Bill Telkom

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Explore Our Example Of Payroll Schedule Change Notice Template Payroll Change Templates

Accountant Hialeah Turbo Tax Irs Audit Letter Must Read To Under Sta Free Basic Templates Audit Internal Revenue Service

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Deadline To File State Taxes H R Block

Understanding Your Property Tax Bill Clackamas County

List Of State Income Tax Deadlines For 2022 Cpa Practice Advisor