san francisco sales tax rate breakdown

6 rows The San Francisco County California sales tax is 850 consisting of 600 California state. In addition to the statewide sales and use tax rate some cities and counties have voter- or local government-approved district taxes.

Understanding California S Sales Tax

There are a total of 474 local tax jurisdictions across the state collecting an average local tax of 2617.

. San Francisco Tourism Improvement District. San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days. The transient occupancy tax is also known as the hotel tax.

The sales tax jurisdiction name is San Jose Hotel Business Improvement District Zone A which may refer to a local government division. The December 2020 total local sales tax rate was 9250. The state tax rate the local tax rate and any district tax rate that may be in effect.

4 rows Sales Tax Breakdown. A base sales and use tax rate of 725 percent is applied statewide. The County sales tax rate is.

4 rows Sales Tax Breakdown. San Francisco California sales tax rate. You can print a 9875 sales tax table here.

Presidio San Francisco 8625. Since 1974 the San Francisco sales tax rate has increased eight times from 650 percent to the current rate of 850 percent. California has a 6 sales tax and San Bernardino County collects an additional 025 so the minimum sales tax rate in San Bernardino County is 625 not including any city or special district taxes.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. South San Francisco CA Sales Tax Rate. The current total local sales tax rate in South.

You can print a 9875 sales tax table here. State sales and use taxes provide revenue to the states General Fund to cities and counties through specific state fund allocations and to other local jurisdictions. Presidio of Monterey Monterey 9250.

Average Sales Tax With Local. California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. File Monthly Transient Occupancy Tax Return.

4 rows 8625 tax breakdown. The tax is collected by hotel operators and short-term rental hostssites and remitted to the City. The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax.

A base sales and use tax rate of 725 percent is applied statewide. Sales tax does not apply to Aviation Gasoline used to propel aircraft except for Aircraft Jet Fuel when the purchaser presents the Exemption Certificate for Motor Vehicle Fuel for Propelling Aircraft found in Regulation 1598 Motor Vehicle and Aircraft. This is the total of state and county sales tax rates.

The statewide tax rate is 725. Sales Tax Breakdown. Notes for Motor Vehicle Fuel Gasoline Rates by Period.

District tax areas consist of both counties and cities. The California sales tax rate is currently. The 9875 sales tax rate in San Bruno consists of 6 California state sales tax 025 San Mateo County sales tax 05 San Bruno tax and 3125 Special tax.

Those district tax rates range from 010 to 100. The December 2020 total local sales tax rate was 9250. What is the sales tax rate in San Jose California.

For tax rates in other cities see California sales taxes by city and county. The San Jose sales tax rate is. South San Francisco CA Sales Tax Rate.

The sales and use tax rate in a specific California location has three parts. Did South Dakota v. Your Income Taxes Breakdown.

Sales tax region name. Since 1974 the San Francisco sales tax rate has increased eight times from 650 percent to the current rate of 850 percent. 5110 cents per gallon of regular gasoline 3890 cents per gallon of diesel.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The sales and use tax rate varies depending where the item is bought or will be used. California has a 6 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes.

This table shows the total sales tax rates for all cities and. Its base sales tax rate of 725 is higher than that of any other state and its top marginal income tax rate of 133 is the highest state income tax rate in the country. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for San Jose California is.

Frequently Asked Questions City Of Redwood City

Sales Tax By State Is Saas Taxable Taxjar

California Sales Tax Rate By County R Bayarea

California Sales Use Tax Guide Avalara

Understanding California S Sales Tax

California Sales Tax Rates By City County 2022

California City County Sales Use Tax Rates

Sales Tax Collections City Performance Scorecards

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Us Sales Tax On Orders Brightpearl Help Center

Understanding California S Sales Tax

How Do State And Local Sales Taxes Work Tax Policy Center

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

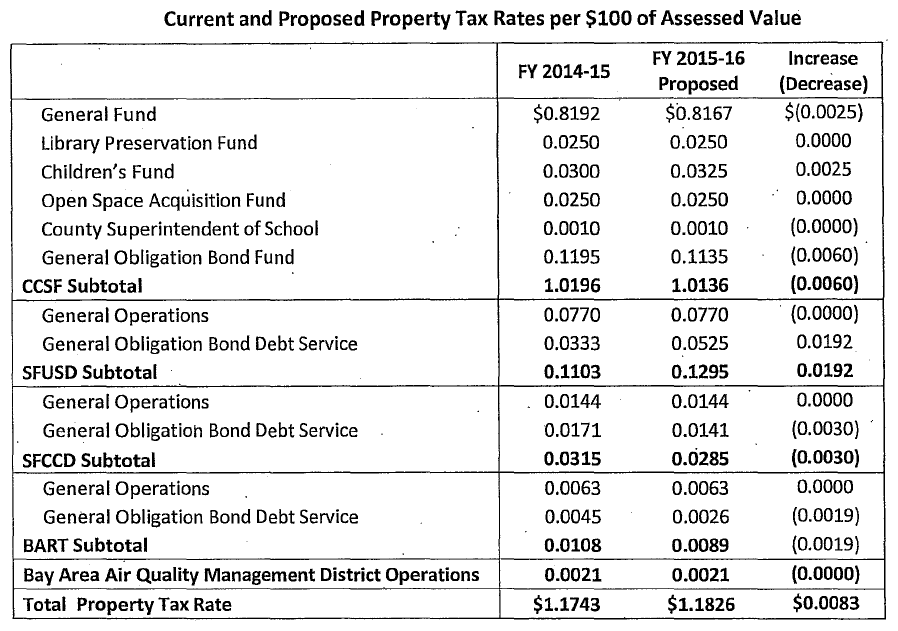

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

How Do State And Local Sales Taxes Work Tax Policy Center

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Understanding California S Sales Tax

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute